Financial Technology: Developing a digital debt collection solution

Financial Technology (FinTech) is changing the way businesses operate. The Debt Register is a subscription-based, cloud SaaS platform that facilitates the automated chasing of a company’s debts. It uses Artificial Intelligence to automatically handle the sometimes long and arduous process of tracking, communicating and chasing unpaid invoices. The platform provides oversight and convenience to the companies whilst massively improving the chances of recovering the debt and getting paid.

The platform helps enterprises at all levels, but predominantly medium to large businesses with significant P&Ls and consequently a potentially extensive list of late payers or debtors.

Pioneering the future

The future of financial recovery

The Debt Register is an entirely new business, spinning out of an existing financial recovery business. The platform aims to automate the complex tasks and process those types of companies perform.

To develop detailed specifications, we ran a series of planning and scoping sprints with the business owners and stakeholders. With their excellent understanding of the industry, they had an unmistakable idea of how their software platform solves business challenges.

Lighflows helped develop their vision into a tangible and achievable product roadmap, with an initial Minimal Viable Product, followed by further sprints to deliver more features.

Journeys that prioritise user needs

Customer journeys

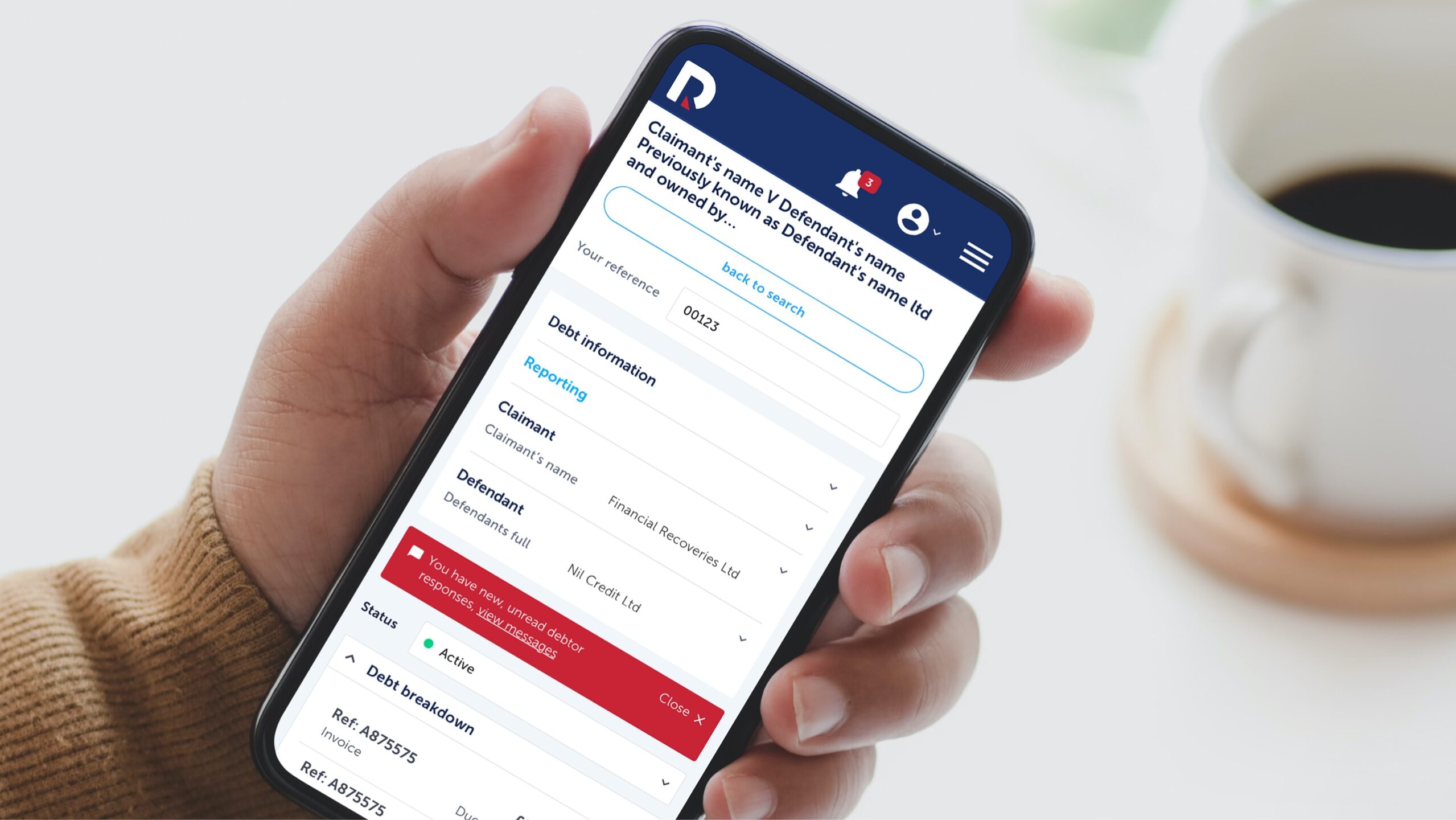

As with any successful software project, we always have the customer in mind – we put ourselves in their shoes and ensure that we deliver an intuitive experience.

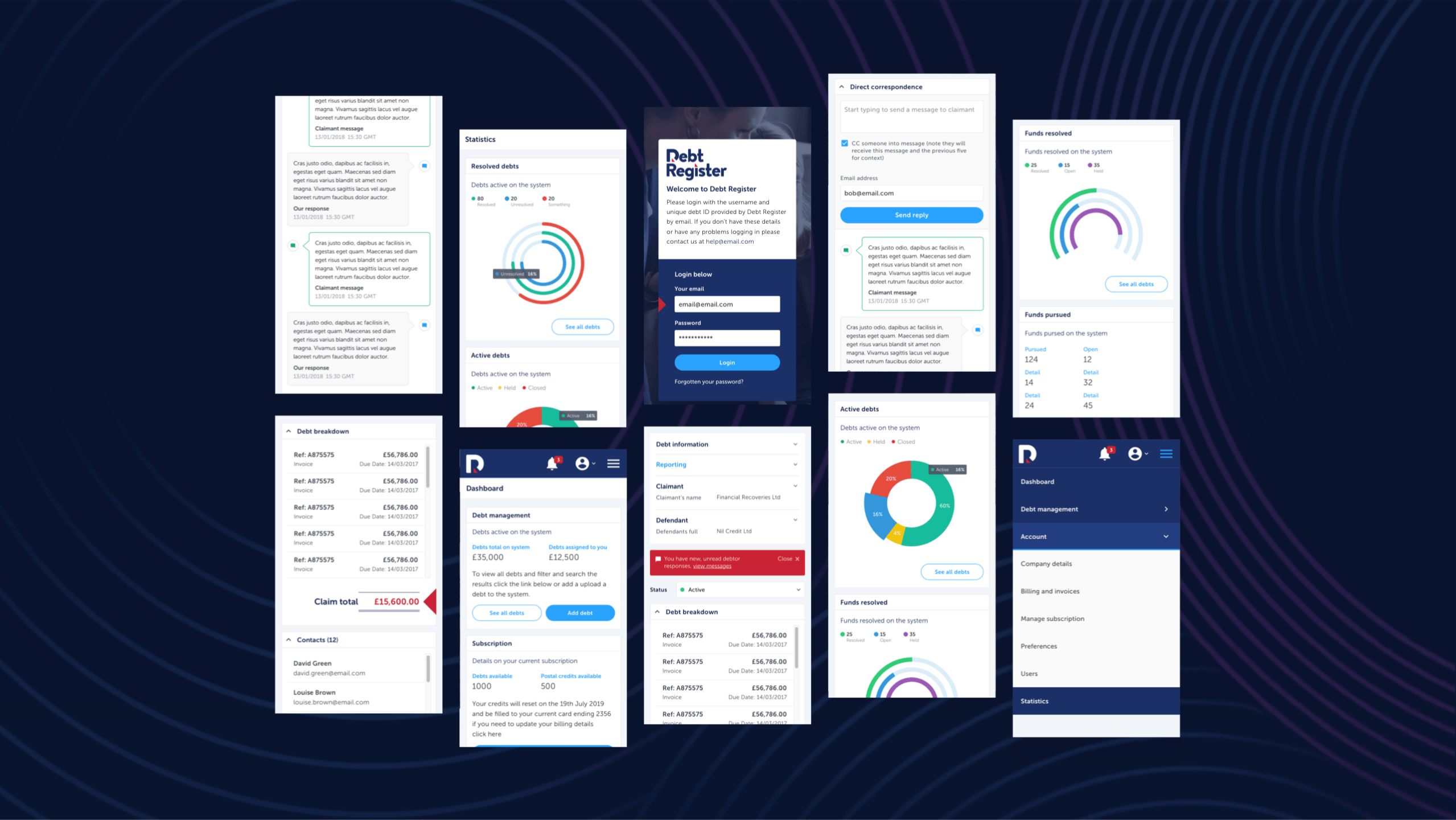

To achieve this, several stakeholder sessions we organised. We used Miro to create clear and simple customer journeys for the two primary audiences of the app; Debtors and Companies (creditors)

For companies, we focussed on a simple setup process to start collecting debts in just a few minutes. We made it easy for the debtors to respond to communications from the creditor and supply information to resolve the issues.

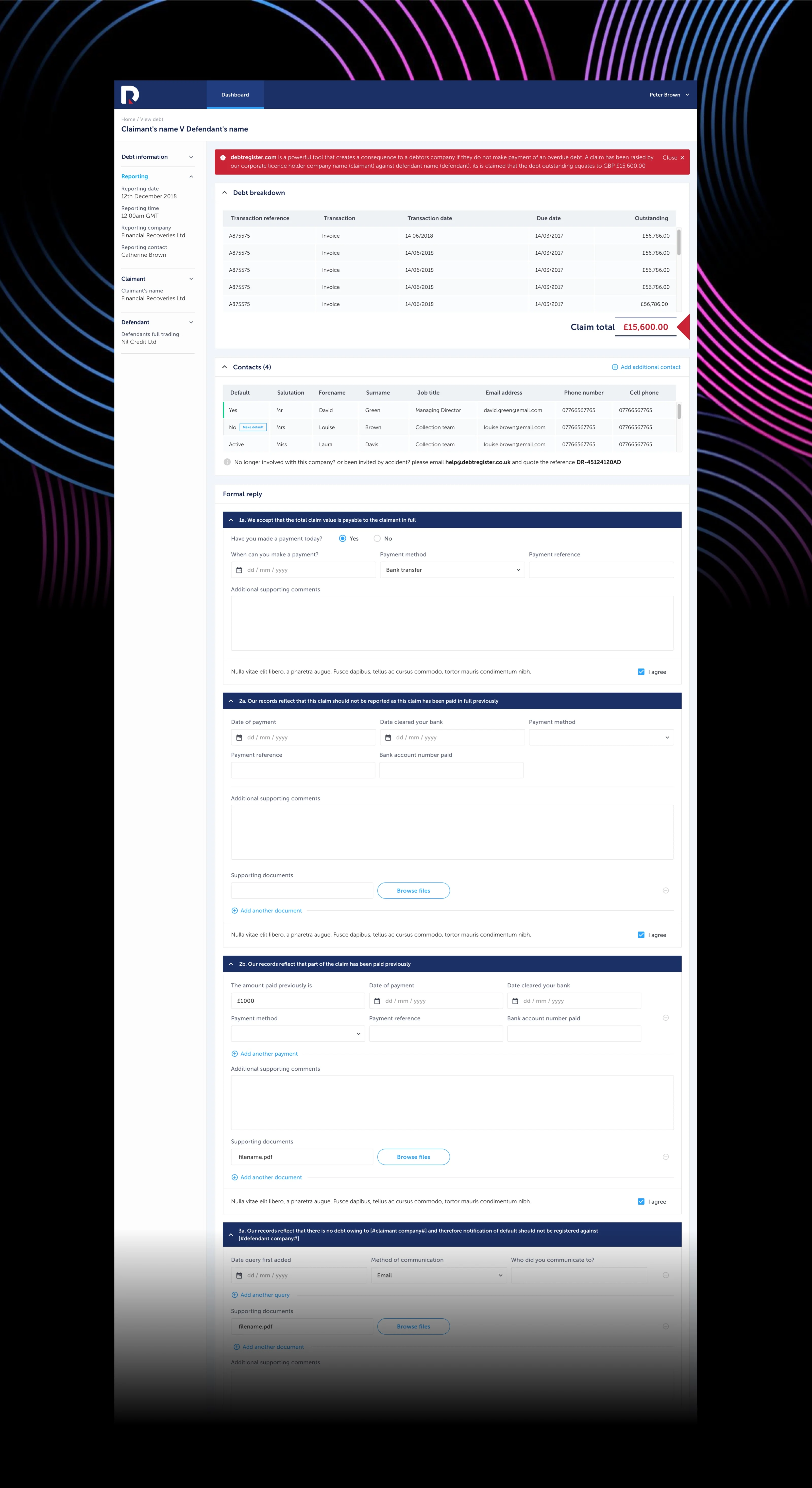

Due to the scale and complexity of the product, Axure RP was used to produce interactive wireframes, so there were working prototypes for nearly every page. This process allowed us to refine the navigation system, messaging and functionality. Both teams valued this process which helped crystallise the requirements and define the information architecture that would support the project.

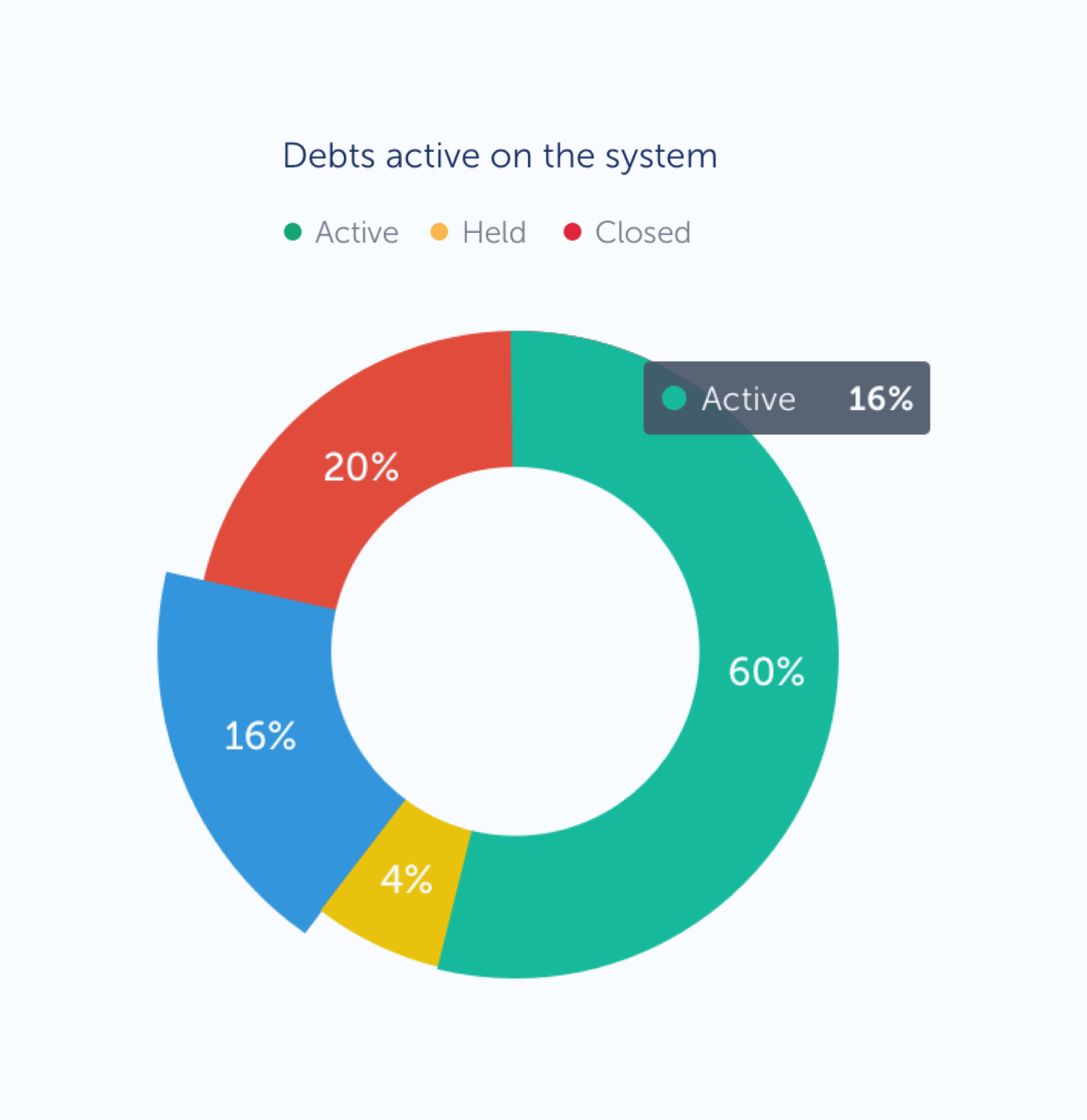

Once in the design phase, the Lightflows team created a design system that would support the various complex financial information and debt statuses. A carefully chosen colour scheme and iconography help customers read the status of the debts and identify priorities and actions.

The solution

Powerful workflows

The Debt Register automatically handles all aspects of debt collections, including financial transactions, communications chains, email messages, notifications, and even sending physical letters.

At its core, the platform is an event and AI-driven system which runs regular workflows to process the debts on behalf of the client.

These workflows can include sending messages, notifications, updating statuses, calculating fees and interest and many more and can be triggered at set times and days in any time zone.

Lightflows produced A workflow design tool, allowing the admin team at Debt Register to completely customise, create new and tailor workflows on a client-specific basis. All told, this makes a powerful SaaS system.

The results

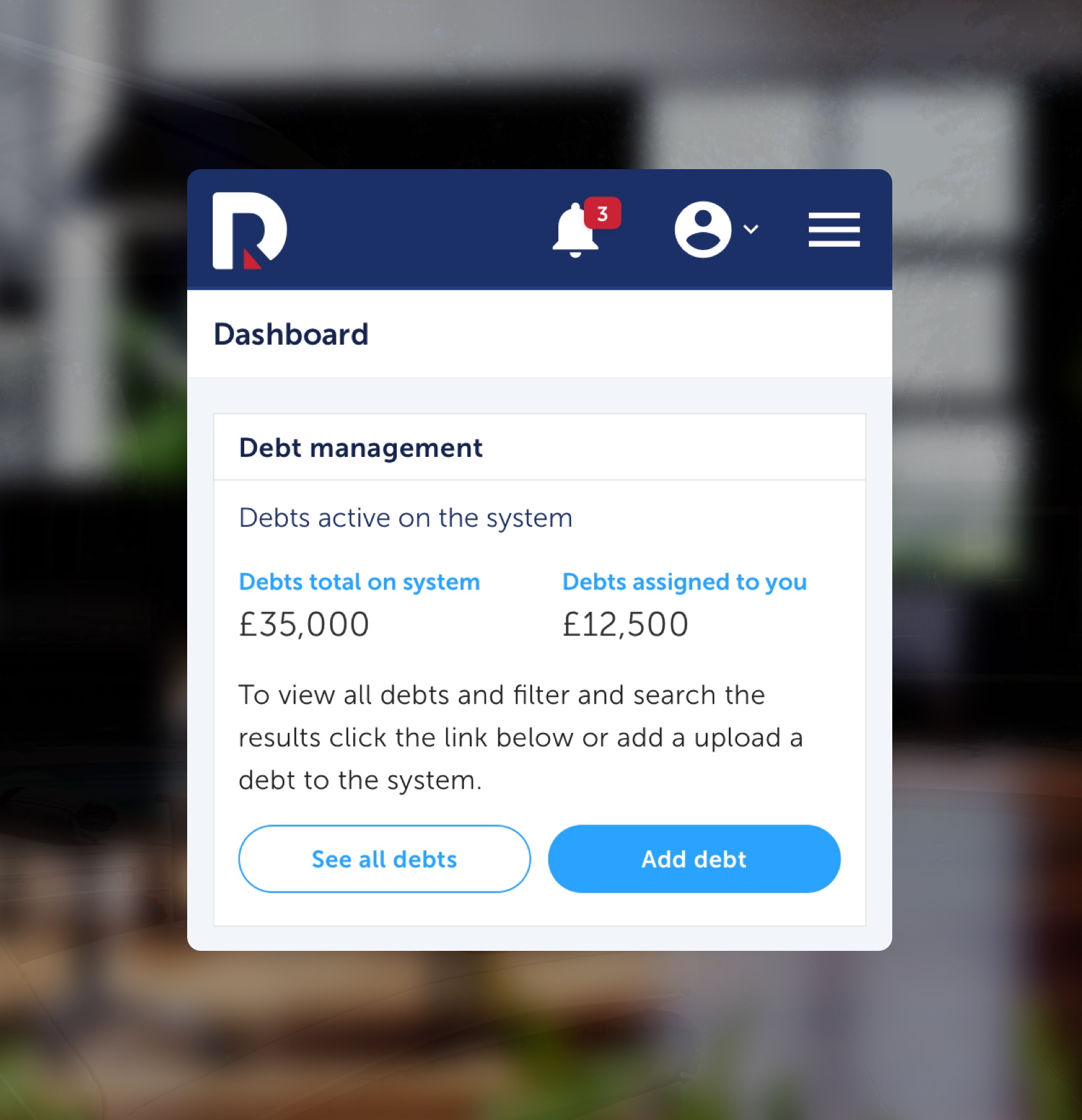

Information at your fingertips

A powerful custom search and filtering interface with ever-present controls makes it easy for customers to find information and track the progress of debt recovery.

Interactive statistics pages and reports provide valuable insights and performance metrics which all add value to the company chasing their funds and reporting back to their teams.

Global communication, simplified

Communicating turns global

Integration with Google’s Cloud Translate services helps the Debt Register product appeal to a global audience. The Debt Register automatically translates incoming and outgoing communications into the end-users native language to facilitate communication in any language, adding even more value.

Developing a SaaS membership system

An initial demo onboarding call for users wishing to use the platform before access is granted as a free trial. Tiered paid access plans are then available, with bespoke plans for Enterprise businesses too.

All payment and membership handling happen through Stripe. New plans can be created by the Debt Register admin team themselves within the system that we delivered.

Streamlined access with robust technology

The technical bit

An initial demo onboarding call for users wishing to use the platform before access is granted as a free trial. Tiered paid access plans are then available, with bespoke plans for Enterprise businesses too.

All payment and membership handling happen through Stripe. New plans can be created by the Debt Register admin team themselves within the system that we delivered.

The platform is developed as a progressive web app using Laravel for the backend. Both the client-facing pages and administration capabilities use React JS. Integration includes Stripe for payments and SendGrid and Twilio for transactional email and notifications. We are currently in the planning phase with integration to Xero, Quickbooks and Sage.