Innovative Fintech solutions to transform your business

Understanding Fintech and how we can help

Lightflows is your partner in Fintech software development, offering a comprehensive suite of services that includes bespoke Fintech solutions, Fintech mobile app development, cutting-edge UI/UX design, digital banking excellence, Fintech payment innovations and data analytics. Our team of developers is your guarantee of tailored, best-in-class financial software solution.

Fintech software development is the powerhouse driving financial innovation. Therefore, it’s about crafting tailored digital solutions for the financial sector, covering everything from mobile payments to digital wallets, compliance tools and core banking systems. As a result, our Fintech developers harness cutting-edge tech like blockchain and artificial intelligence to redefine financial products and supercharge the customer journey.

FinTech development solutions

In the rapidly evolving landscape of financial technology, our suite of services encompasses a wide array of financial service applications designed to meet the diverse needs of businesses and individuals alike.

As a UK-based FinTech software developer, we specialise in tailoring cutting-edge solutions for finance. Our seasoned team crafts secure, user-friendly financial software using blockchain and AI. We also champion customer satisfaction, empower digital transformation and streamline financial processes for growth in FinTech. Let us walk you through our approach to creating and delivering FinTech solutions that drive digital success.

Our solutions

01

Payments & digital wallets

02

Blockchain

03

Wealth management

04

Investment management

05

Custom FinTech applications

06

Accounting Information Systems (AIS)

07

Insurance

08

Personal finance

09

Background check software

10

Financial reporting software

11

Financial calculators

01 /

Payments & digital wallets

Our tailor-made software products redefine convenience and security, empowering users to effortlessly navigate their financial world. Notably, we know the importance of data privacy and cybersecurity, so our online payment solutions, spanning B2B transaction platforms and digital wallets, are always compliant when managing sensitive information.

02 /

Blockchain

Blockchain technology is a game-changer in FinTech For instance, it gives security by warding off fraud, guarantees third-party elimination and paves the way for trusted data exchange. Undoubtably, for financial services firms, stability and security are paramount, ensuring data integrity and aligning with industry benchmarks for top-tier security and confidentiality.

03 /

Wealth management

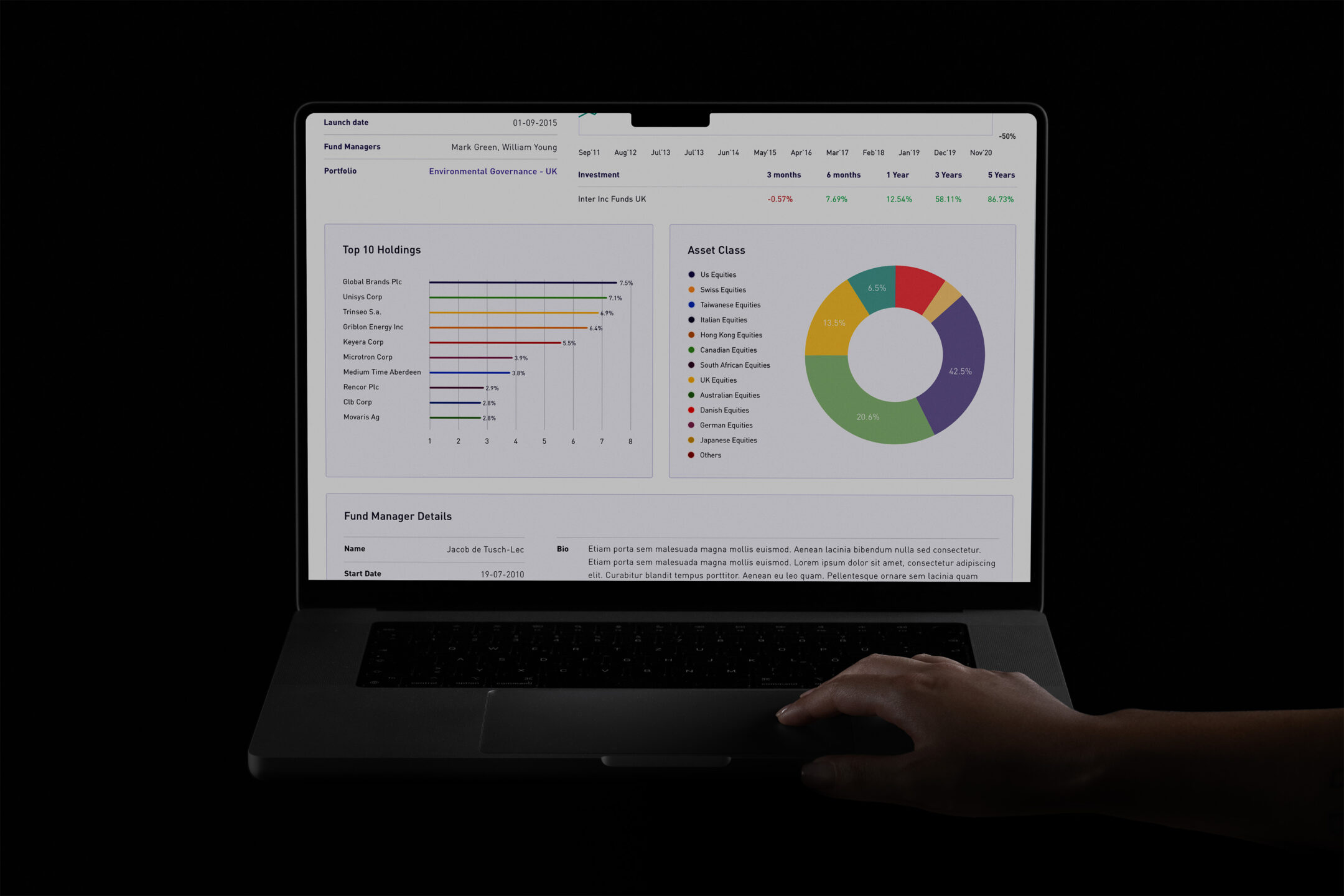

The FinTech revolution has transformed wealth management. Moreover, we’ve worked with several parters to deliver cutting-edge FinTech apps that accelerate asset management, personal investing and financial analytics, harness data-driven insights for trend tracking and seamless communication.

04 /

Investment management

We can help develop your investment platforms and asset management systems. For instance, with real-time performance trackers, advanced analytics and powerful reporting tools.

05 /

Custom FinTech applications

Tailored Fintech solutions enhance user experiences by providing insightful spending analytics, advanced fraud detection, and robust risk management tools. These applications help businesses navigate the digital finance landscape, ensuring compliance and customer satisfaction.

06 /

Accounting Information Systems (AIS)

AIS integrates with ERP systems and business intelligence tools, streamlining financial data capture, processing, and analysis. As a result, this leads to accurate financial reporting, regulatory compliance, and decision-making support, enhanced by automation and real-time data synchronization.

07 /

Insurance

Fintech software for insurance improves underwriting, claims processing, fraud prevention, and billing. It also enables insurance companies to streamline operations, increase productivity, and enhance customer satisfaction through efficient and automated processes.

08 /

Personal finance

Personal finance software solutions offer tools for budget management, mobile payments, online banking, and financial planning. Users also gain control over their finances through features that support expense tracking, savings analysis, and smart budgeting.

09 /

Background check software

Background check software verifies personal and organisational information, reducing fraud and identity theft risks. In addition, features include identity verification and criminal, credit, and employment history checks, ensuring the integrity of financial processes.

10 /

Financial reporting software

Automated financial reporting software facilitates precise and efficient analysis of financial transactions. It also supports financial institutions in achieving accuracy and streamlining reporting processes with tools like QuickBooks, Xero, and other financial services.

11 /

Financial calculators

Financial calculators aid in personal and business financial planning, offering solutions for mortgage, retirement, investment, loan, and compound interest calculations. These tools enhance accuracy, decision-making, and customer service by providing quick financial insights.

Design, UI and UX

Our UI/UX design services streamline financial products, focusing on intuitive and engaging interfaces. By turning complex data into clear visuals and incorporating analytics dashboards, we make decision-making easier. Our web apps enhance client interactions and provide seamless access to financial services.Moreover, our process, from design to prototyping with tools like Figma and Sketch, is geared towards aligning with your business objectives, ensuring a polished, user-focused product. Explore our bespoke UI/UX solutions tailored for the financial sector.

Data science

Data science experts at Lightflows excel in processing large datasets and training AI/ML models for valuable business intelligence. Utiliising PowerBI, Tableau and Google Looker Studio, we employ state-of-the-art tech for real-time, data-driven decision making. Furthermore, our big data analytics expertise enhances operational insights, process optimisation and business expansion. Through AI/ML models, we uncover data patterns and trends, empowering confident data-based choices. Collaborate with us to harness data science’s potential and open new doors.

Innovative, custom and bespoke web apps

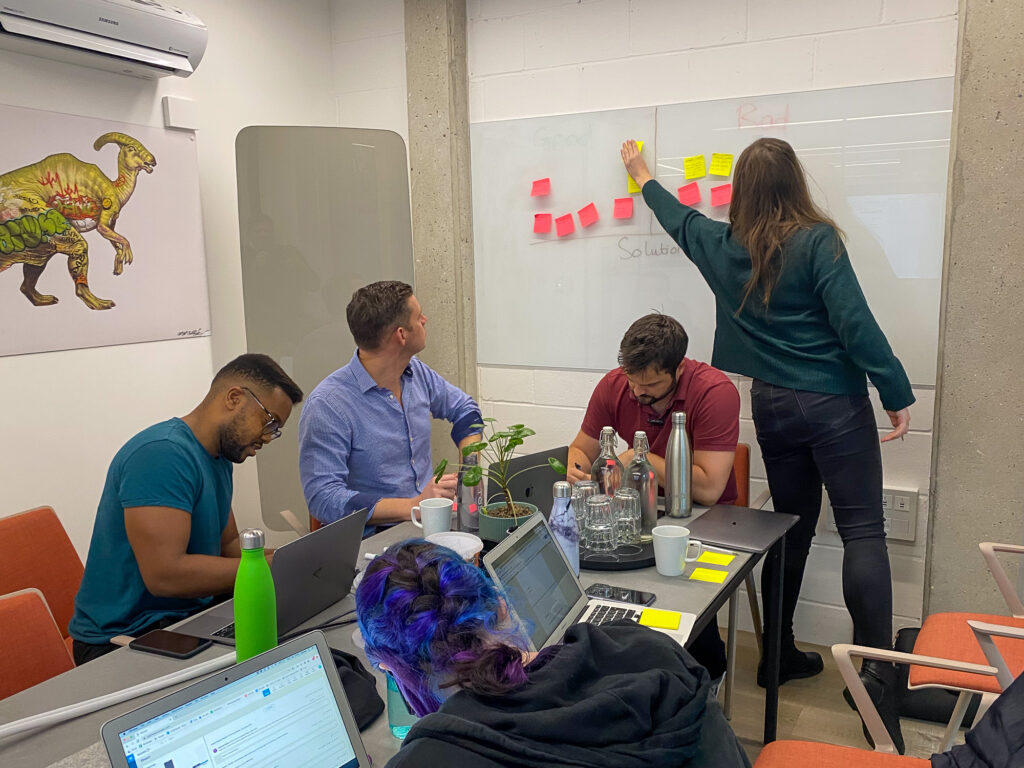

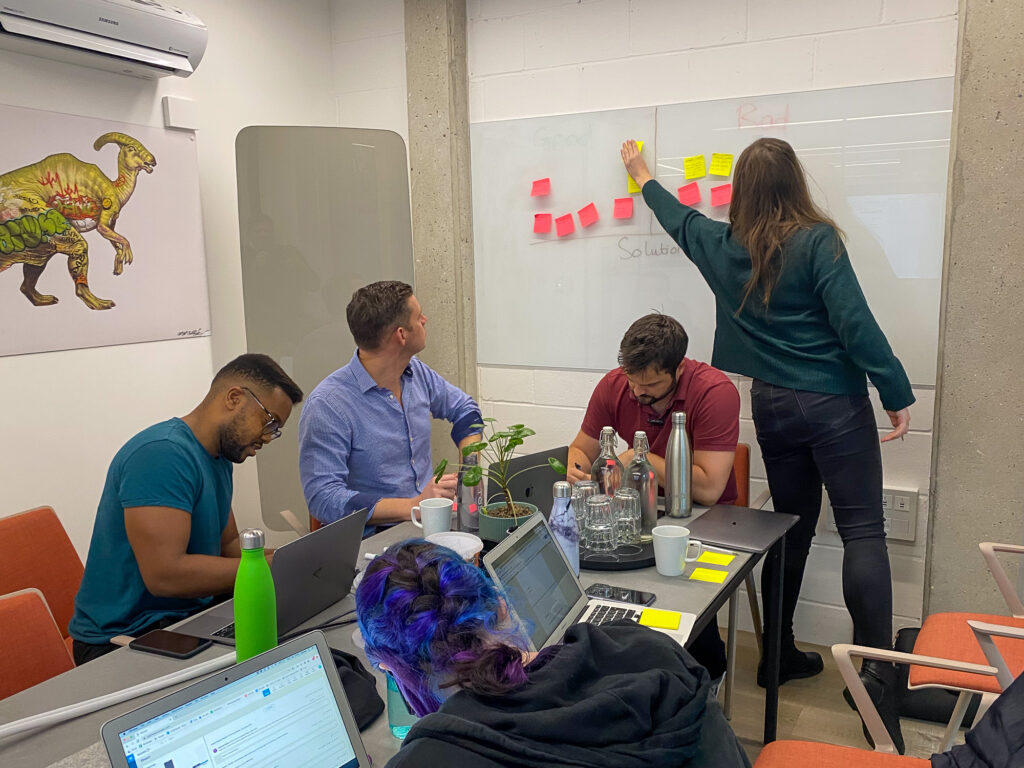

The discovery phase

Our discovery phase is pivotal in our approach to fintech product development, focusing on detailed requirements gathering for a tailored solution. Our Business Analysts help our clients grasp their long-term needs, to ensure a satisfying final product. At Lightflows, we recognise that this thorough phase is vital for addressing challenges and maximising the potential of your fintech product.

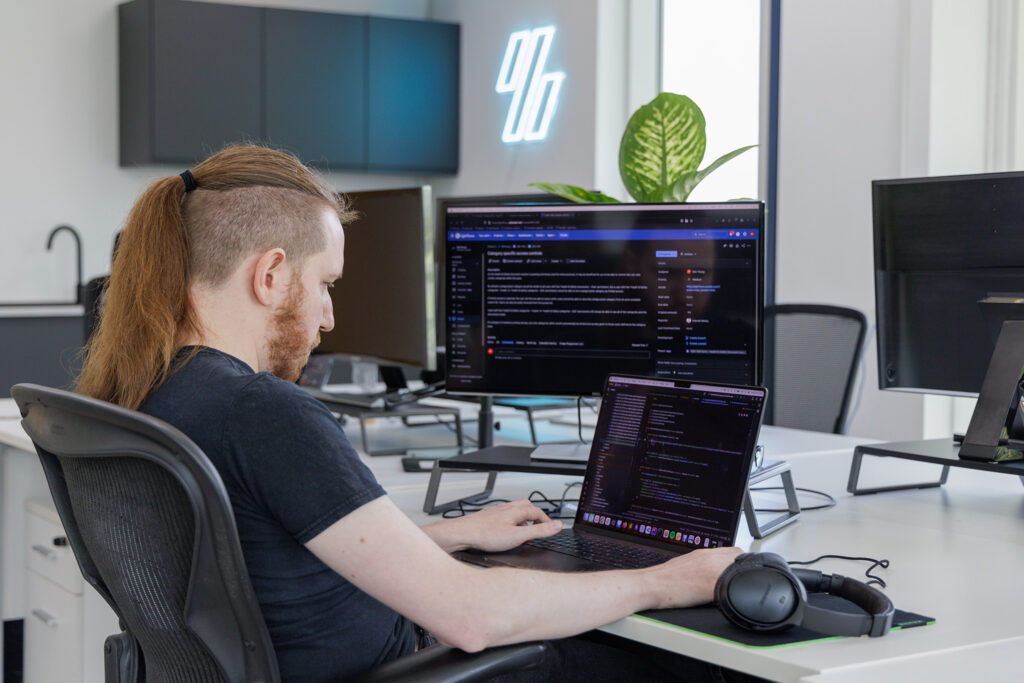

Dedicated FinTech engineers

Lightflows team of seasoned fintech engineers specialises in the development of finance software, including bespoke trading platforms and advanced mobile banking applications. Notably, our team’s depth of experience ensures the delivery of high-quality results. Therefore, partnering with us gives businesses access to this expertise, leveraging our engineers’ skills to successfully drive their projects.

Security and regulatory compliance

Lightflows offers comprehensive security and regulatory compliance services in fintech software development. Our experience covers robust security protocols, data privacy measures and compliance standards for regulatory requirements. We also prioritise transparent data ownership, secure architectures and employ practices like logging, encryption and tokenisation. Our ISO27001 certification and Cyber Essentials Plus accreditation demonstrate our commitment to data security. Partner with Lightflows to ensure compliance, mitigate risks and protect sensitive data across your fintech software development projects.

DevOps

DevOps plays a vital role in fintech software development, especially in the post-pandemic era, where timely innovation and uninterrupted service are crucial. By automating routine operations and facilitating audits, DevOps ensures quick releases and better collaboration for operational efficiency. It also helps reduce downtime and deployment delays, enabling fintech companies to stay ahead. With DevOps, financial institutions can achieve faster time-to-market, streamline workflows and deliver high-quality digital products. By embracing DevOps, our fintech software developers can adapt to changing customer needs, implement cutting-edge technologies and comply with regulatory requirements seamlessly. Therefore, in the fast-paced world of fintech, DevOps methodology empowers us to overcome challenges and deliver superior customer experiences.

Quality assurance

At Lightflows, our QA services are vital for ensuring software quality and adhering to industry standards. We commence with an initial audit, identifying process enhancements. Thorough performance testing assesses system stability under various loads, while automated testing detects issues early, reducing costs. In addition, our seasoned quality assurance experts adhere to industry best practices, prioritising customer satisfaction, regulatory compliance and innovative solutions. Also with deep financial industry insight, we’re dedicated to delivering secure, reliable fintech software aligned with your business goals. Rely on us for QA and discover the difference.

Product development

Our tailored fintech software development follows a concise process. We begin with requirements gathering, research and estimation to understand clients’ needs and create a project roadmap. Next our team then choose the appropriate tech stack and hone in on UI/UX design for user-friendly interfaces, before our skilled developers build the software with agile methods, ensuring quality and security.

We prioritise quality assurance, security checks and regulatory compliance and collaborate closely with you for a successful product launch. Furthermore, our custom financial software solutions drive customer engagement and satisfaction, backed by our experience and commitment to excellence. Trust Lightflows for your fintech needs.

Your digital journey

Working in the fast paced world of tech, our sweet spot is helping entrepreneurs and buinesses bring their product ideas to life. And with over 15 years of experience, we’ve learnt a thing or two.

In addition to working with established businesses, we have helped several funded startups achieve success, developing MVPs, building their digital products, scaling their tech and infrastructure, and eventually selling those businesses. We can bring that experience to you.

Let’s talk about your plans and see if we can help.

Why Lightflows for your app project

When it comes to fintech software development, Lightflows stands head and shoulders above the competition. Plus we have extensive experience and a track record of excellence in crafting tailor-made financial solutions.

Experienced team

Our industry expertise means we speak your language, grasping the unique challenges you face and delivering solutions tailored to your needs.

Transparency at every step

What truly sets us apart? An unwavering commitment to transparency. For instance, we believe in openness, honesty and accountability at every twist and turn of the development journey. Similarly, we don’t just listen, we provide visual and technical insights early in the process, so you’re always in the driver’s seat.

Communication and collaboration

We know that communication and collaboration are the cornerstones of success, and we make them our guiding principles, ensuring everyone stays aligned and informed throughout the process.

Scalability of services

Scalability is crucial in Fintech development, enabling services to adapt seamlessly to growing demands and evolving client needs. A scalable approach ensures long-term success and fosters strong client partnerships.

Ready to start the

conversation?

Case Studies

Case Studies

Case Studies

Case Studies

Let’s work together

Do you have a project in mind? Or do you need some further information about our services? Feel free to get in touch below.

Enquiry Form

FAQ about FinTech

FinTech software development is the powerhouse driving financial innovation. Therefore, it’s about crafting tailored digital solutions for the financial sector, covering everything from mobile payments to digital wallets, compliance tools and core banking systems. As a result, our FinTech developers harness cutting-edge tech like blockchain and artificial intelligence to redefine financial products and supercharge the customer journey.

Why opt for FinTech software development services? In today’s digital landscape, they’re key for financial institutions and FinTech startups aiming for the competitive edge. Therefore, with these services in your corner, you’ll revolutionise your operations, streamline finances, amp up customer engagement and ace regulatory compliance. Moreover, custom fintech software development opens doors to user-friendly financial solutions, setting the stage for unparalleled customer satisfaction. The bottom line? It’s your shortcut to success in the digital era.

Lightflows is your trusted partner on the FinTech development journey, armed with a wealth of experience in creating tailor-made financial services and FinTech apps. Our FinTech development team boasts mastery in cutting-edge technologies, showcasing a stellar track record of delivering financial industry triumphs. We also commit to transparency, effective communication and collaboration throughout the development process. Therefore, with Lightflows by your side, rest assured we not only understand your unique challenges but also possess the skills to craft bespoke Fintech solutions that match your every need. Additionally, your success is our priority, and we are firmly dedicated to helping you achieve it.

The duration of a FinTech software development process depends on the complexity and scope of the project. Therefore, during the initial discovery phase, our team works closely with the client to understand their requirements and define project timelines. As a result, we strive to provide a realistic estimate of the development timeline upfront, taking into account the various stages of design, development, testing and implementation. Regular communication and timely feedback from the client also play a crucial role in ensuring an efficient development process.

The pricing of FinTech software development services fluctuates, depending on elements like project intricacy, scope and feature preferences. At Lightflows, we specialise in crafting personalised solutions that align with our clients’ unique needs and financial plans. Our initial consultation is where we delve into your requirements, offering a cost estimate. Throughout the process, we commit to cost-effectiveness, as we make it our mission to provide top-tier FinTech solutions that not only meet but surpass expectations, all while staying within the agreed budget.

Yes. At Lightflows, we have extensive experience in developing FinTech software solutions that adhere to regulatory compliances within the financial industry. Our team is well-versed in the regulations and standards governing financial processes, ensuring that all software developments meet the necessary compliance requirements. We work closely with our clients to understand their specific compliance needs and incorporate them into the development process. By leveraging our expertise in FinTech software development and compliance solutions, we help our clients navigate the regulatory landscape and ensure their software solutions are compliant and secure.

At Lightflows, we believe in maintaining transparency and collaboration throughout the FinTech software development process. As a result, we provide our clients with visual and technical designs early in the process, allowing them to have a clear understanding of the project’s direction and progress. Therefore, by actively seeking client input and feedback at every stage, we ensure that their requirements are met. In addition, clients have regular communication channels with our development team and we also conduct regular progress meetings to keep them informed and involved in the development process. To conclude, our goal is to ensure that our clients are actively engaged in the development of their FinTech software solution.

At Lightflows, our commitment to our clients extends beyond the development phase. Moreover, we offer ongoing support and maintenance services to ensure the long-term success and smooth operation of their FinTech software solutions. Our dedicated support team is available to address any technical issues, provide updates and also offer guidance whenever needed. In addition, we offer regular software updates and upgrades to incorporate new features, enhancements and security patches. Overall, our aim is to provide comprehensive support and maintenance services that allow our clients to focus on their core business while having the assurance that their FinTech software is well-supported and always up to date.